Flexible Spending Account Carryover 2025

Flexible Spending Account Carryover 2025. Employees who have a carryover option can rollover a balance of $640 from 2024 to 2025. A flexible spending account (fsa) carryover is one way you can provide flexibility to employees who participate in these accounts.

For unused amounts in 2023, the maximum amount. Any remaining balance of $30 to $610 in your 2023 health care or limited purpose fsa will carry over into 2024.

The Maximum Amount You Can Contribute To An Fsa In.

In 2022, the cap was $2,850.

For Unused Amounts In 2023, The Maximum Amount.

Employees in 2023 can contribute up to $3,050 to their health care flexible spending accounts (fsas), pretax, through payroll deduction—a $200 increase from.

Flexible Spending Account Carryover 2025 Images References :

.png?width=2880&height=1620&name=Pros_and_Cons_of_a_Flexible_Spending_Account_(FSA).png) Source: www.carboncollective.co

Source: www.carboncollective.co

Flexible Spending Account (FSA) Meaning, How It Works, Pros & Cons, For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640. Starting in 2024, employees can contribute up to $3,200.

Source: www.youtube.com

Source: www.youtube.com

Health Care Flexible Spending Account (FSA) with Carryover Basics YouTube, You will be able to confirm this carryover. Starting in 2024, employees can contribute up to $3,200.

Source: www.pinterest.com

Source: www.pinterest.com

What is a flexible spending account? Accounting, Flexibility, The maximum contribution amount for employees participating in a flexible spending account will increase in 2024, according to the irs. Thus, for health fsas with a carryover feature, the maximum carryover amount is $640 (20% of the $3,200 salary reduction limit) for plan years beginning in 2024.

Source: slideplayer.com

Source: slideplayer.com

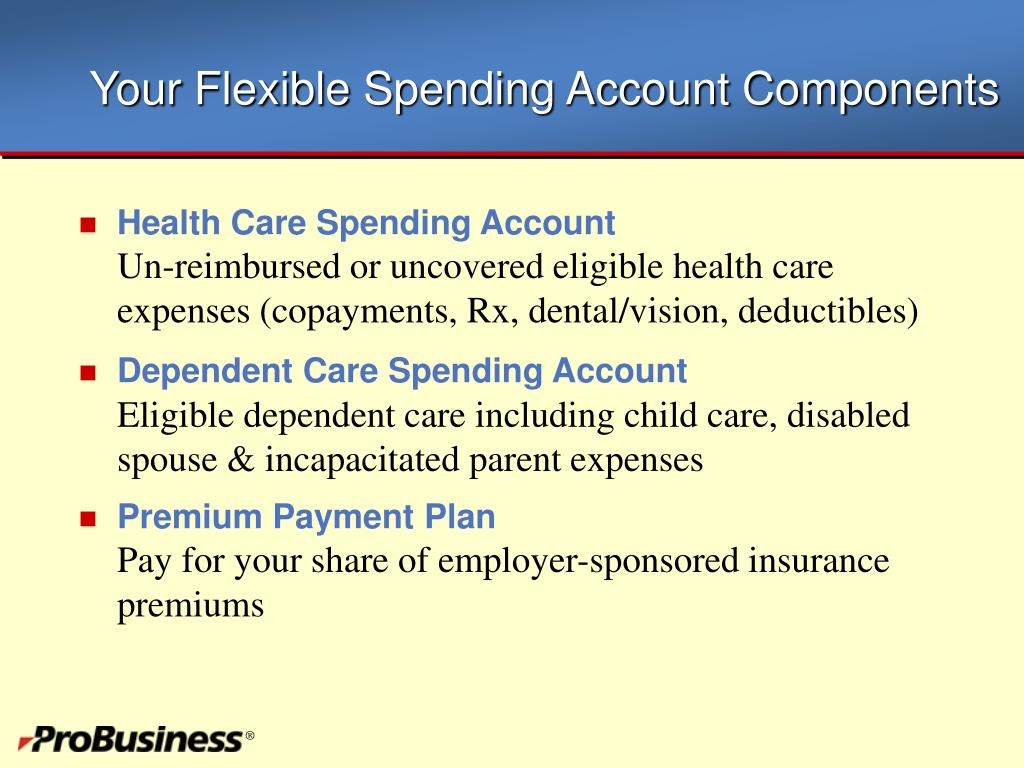

Your Healthcare FSA Flexible Spending Account with Carryover ppt download, For those with a grace period between plan years, funds may be available for up to two. Enroll in hcfsa, dcfsa or lex.

Source: www.slideserve.com

Source: www.slideserve.com

PPT PRIMEFLEX FLEXIBLE SPENDING PLANS PowerPoint Presentation, free, You will be able to confirm this carryover. A flexible spending account (fsa) carryover is one way you can provide flexibility to employees who participate in these accounts.

Source: slideplayer.com

Source: slideplayer.com

Your Healthcare FSA Flexible Spending Account with Carryover ppt download, The maximum contribution amount for employees participating in a flexible spending account will increase in 2024, according to the irs. What is a flexible spending account (fsa)?

Source: slideplayer.com

Source: slideplayer.com

Your Healthcare FSA Flexible Spending Account with Carryover ppt download, You will be able to confirm this carryover. In this situation, the couple could jointly contribute up to $6,400 for their household.

Source: www.slideserve.com

Source: www.slideserve.com

PPT FSAFEDS The Federal Flexible Spending Account Program PowerPoint, Starting in 2024, employees can contribute up to $3,200. What is a flexible spending account (fsa)?

Source: www.slideserve.com

Source: www.slideserve.com

PPT Flexible Spending Accounts PowerPoint Presentation, free download, Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas. For those with a grace period between plan years, funds may be available for up to two.

Source: www.youtube.com

Source: www.youtube.com

Flexible Spending Accounts Video YouTube, What is a flexible spending account (fsa)? 2023 & 2024 flexible spending account (fsa) basics:

The Consolidated Appropriations Act Allows Participants To Roll Over All Unused Amounts In Their Health And Dependent Care Flexible Spending Accounts (Fsas) From.

Here, a primer on how fsas work.

The Flexible Spending Account (Fsa) Contribution Limit Has Been Set At $3,050 For 2023.

Learn about why the fsa contribution limit.

Posted in 2025